At a well-attended event at the State House on January 26, 2016, JTA released their impact report on quality job training programs: “Job Training: Works, Pays and Saves.” This report, supported by SkillWorks, contains extremely compelling data proving the effectiveness of quality job training programs for the participants served, taxpayers, and the economy as a whole.

Looking at graduates from the 12 non-profit, community based training programs included in the study, some notable outcomes include:

- 76% Employment rate

- 675% Increase in total annual earnings

- 80% Reduction in TANF (cash assistance)

The report analyzes the social and economic impacts gained from high-functioning training programs which prepare individuals for successful, long-term careers in growing industries.

Speakers at report’s launch event included: Senator Ken Donnelly, Representative John Scibak, Marybeth Campbell, Executive Director of Skillworks, Ron Walker, Secretary of Labor and Workforce Development, Carmine Guarino, Senior VP of Citizens Bank, Jeff McCue, Commissioner of the Department of Transitional Assistance, John Barros, Chief of Economic Development for the City of Boston, and Trinh Nguyen, Director of the Mayor’s Office of Workforce Development.

Each speaker expressed steadfast support of and commitment to quality community based job training and workforce development programs and more broadly commitment to improving the lives of low-income Bostonians and Massachusetts residents and to ensuring that employers have an accessible pipeline of skilled talent.

READ:Summary | Full Report

“Job Training: Works, Pays, and Saves”

In 2016, the JTA released a major research-based based study – “Job Training: Works, Pays, and Saves” – documenting the economic impact of community-based job training programs.

The results indicate that JTA member agency programs:

• Account for $10.8M in annual earnings by employed graduates of the programs;

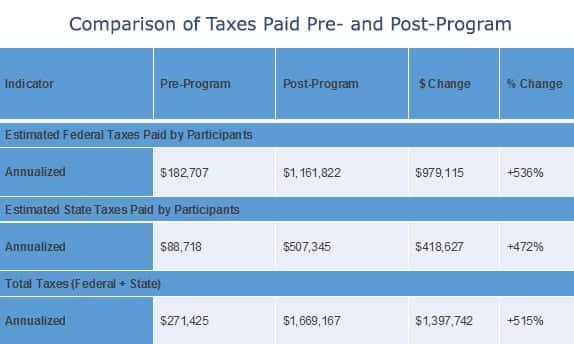

• Contribute to a five-fold increase in paid federal and state income taxes;

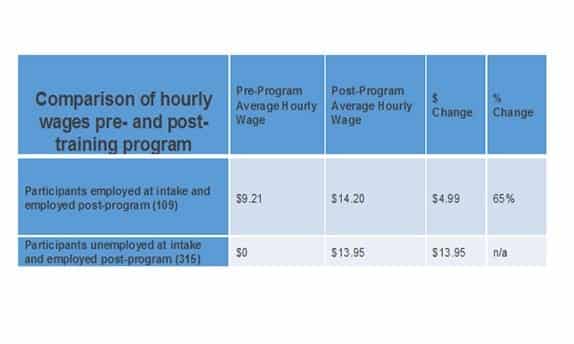

• Raise the average hourly wage of employed participants by 65 percent;

• Contribute to an estimated 80 percent reduction in TANF benefits paid to participants;

• Account for high rates (76 percent) of post-program employment among program graduates;

• Result in $1.9M in reduced public assistance plus new taxes paid.